Thanks to cards we’ve got an option to conduct payments. Transaction gateways must be integrated into digital products for smartphones. Present article discusses such a process and its peculiarities. Let’s begin!

What is a Gateway For Financial Transferrings?

A gateway for financial operations is the ideal financial option since it manages privacy obligations and safeguards consumers of your created app from fraud. Additionally, it provides a fantastic UX, making digital shopping much more practical.

Security is ensured by encoding confidential material, like PINs, bank account numbers, and other personal information. It’s a great feature that lets each user provide a variety of payment services while also shifting all data protection responsibilities to gateways for financial transfers.

What to Take into Account Before Start

Let’s find out what points to get acknowledged before deciding on how to create a mobile banking app.

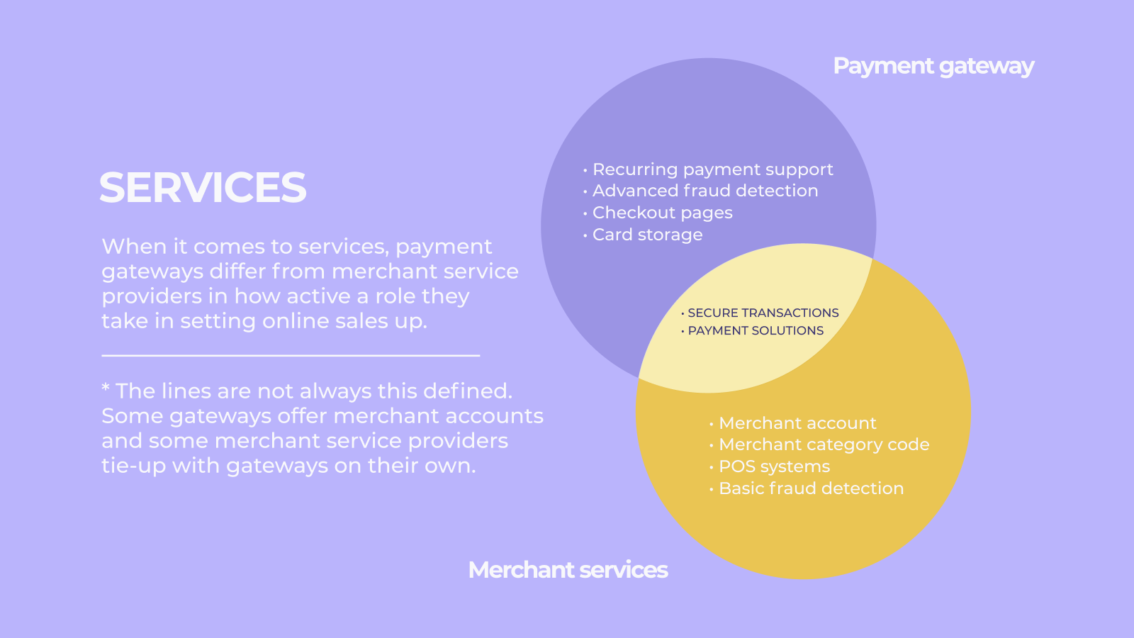

Merchant accounts let you confirm in-app payments. Offering adaptable e-transaction services, merchant accounts may also be utilized in conjunction with PayPal or Stripe.

The following kinds of accounts may be used:

Dedicated — advantageous due to the appropriate financial management adapted to the company’s demands.

Aggregate is significantly more cost-effective than the previous one. However, your financial management options are restricted.

Certificates That Provide Security. If you want to operate with the private financial information of customers, you must comply with PCI DSS regulations. It goes as follows: first, you check to see if your data infrastructure, which stores payment information from clients, conforms with the mentioned guidelines. After that, you must fix all of the vulnerabilities that pentesters found.

A Certified Safety and Security Assessor company then assesses your solution and determines whether to certify it or not.

The Most Prominent Gateway Vendors to Choose From

Pay attention to the options listed below when selecting a payment gateway provider for your app because this factor affects the ultimate fintech app development cost.

PayPal is popular in more than 200 countries and available for different currencies. There are two more PayPal services that make gateway integration simpler: PayPal Payments Pro and PayPal Express Checkout.

Braintree is a PayPal affiliate that offers an integrated security system, two-day withdrawals, and 24-hour customer assistance. Additionally, Braintree provides clients with merchant accounts. The software development kit (SDK) for the payment gateway enables it to function on both iOS and Android smartphones.

Stripe offers a variety of useful tools and features, implemented analysis, and so much more. This payment system also includes Stripe.js, a web development security standard.

Dwolla provides a variety of financial services, such as sending invoices to 2000 individuals and money to thousands of people.

Authorize.Net’s gateway with security enhancements enables connections to websites and mobile applications, as well as efficient data management and the storing of payment templates.

Essential Steps of Integrating a Money Transferring Gateway into a Smartphone App

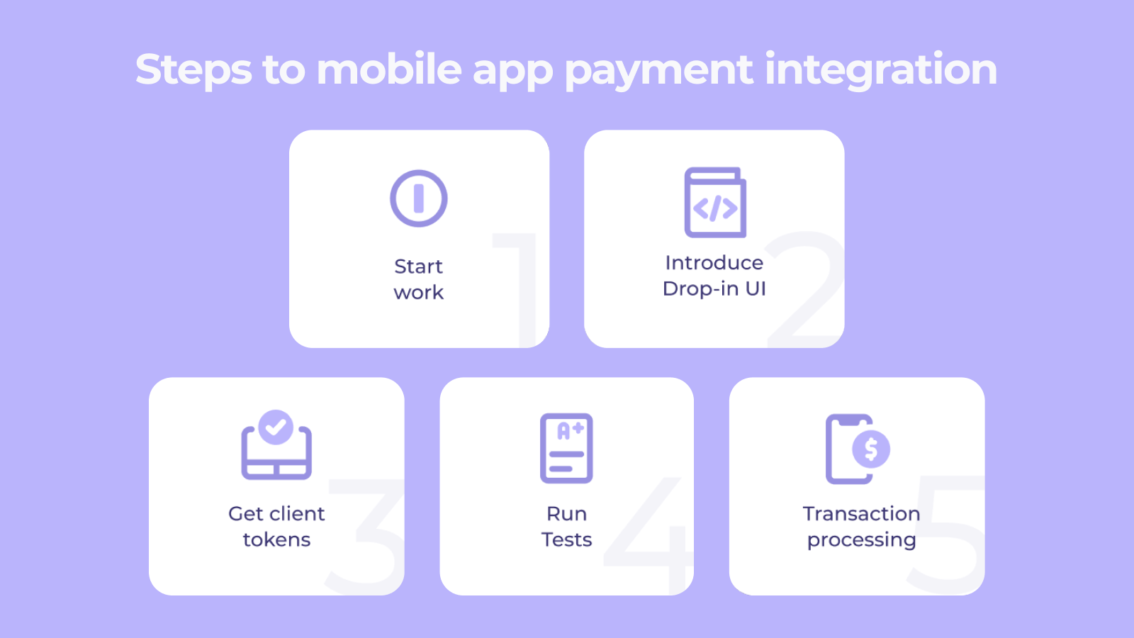

Let’s have a look at the iOS app integration path for the Braintree money transfer gateway. The flow’s the same for Android. One exception is that installing a separate Braintree library made specifically for the Android SDK is required for this platform.

Here’s the gradual integration flow:

Development

Tech-savvy experts append the Braintree to the project with the help of technologies like CocoaPods, Carthage, Swift Package Manager, etc.

Drop-in UI

This stage comprises adding some lines to the code. Yet, you can create a custom UI with the direct credit card info tokenization, so a separate key is not required for each case.

Customer tokens

The server has to produce tokens at the app’s request. It also has to create new tokens after restarting the app.

Performance assessment

The single-use numbers and test credit card info from Braintree are great for assessing the efficiency of the financial gateway. A Braintree sandbox account is required for these purposes.

Performing transactions

Use a one-time financial transaction strategy where sensitive info is provided to a server and used to finish a payment session.

Cards Integration into a Money Transferring Gateway

Customers can perform financial transactions via cards with certain payment gateway providers utilizing the API of a mobile app for making requests. As a consequence, customers enter their card details immediately on the store’s checkout page.

SDKs for Payment Gateway Services

SDKs are offered by payment gateway firms and may be accessed through their websites. Since all solutions are readily available and no PCI DSS certificate is required, integrating with SDKs takes less time.

Summing Up

Implementation of a money transferring gateway simplifies the process of buying digital goods or content. An expert software development provider can perform this operation as securely as possible. Therefore, in order to properly implement a gateway, you should use highly skilled, tech-savvy professionals’ services. This way, you’ll get a top-class solution with a simple and secure payment option.